Forex Market Opening Hours FX Trading Hours

Contents:

Our Research and Education center offers daily updates on all the major trading sessions along with multiple daily briefings on all critical market events which daily shape the global markets. New forex investors should consider opening accounts with firms that offer demo platforms, which let them make mock forex trades. With the practice trades, you can tally gains and losses to see how you would perform with real trading. Once investors learn become more experienced, they can begin making real forex trades. Four major foreign exchange markets in London, New York, Sydney, and Tokyo have different trading hours.

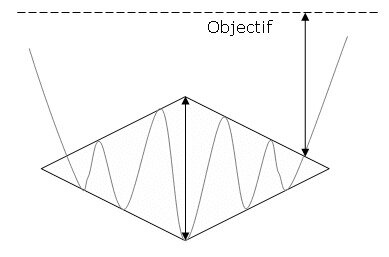

The channel finishes with the opening of the American trading session. The price breaks one of the limits of the channel and moves into the stage of high volatility. Because forex occurs at almost any time of day somewhere in the world, forex traders can access the market at almost any time. This fact contrasts with other markets like stocks or real estate, where traders and investors must wait for their market to open first.

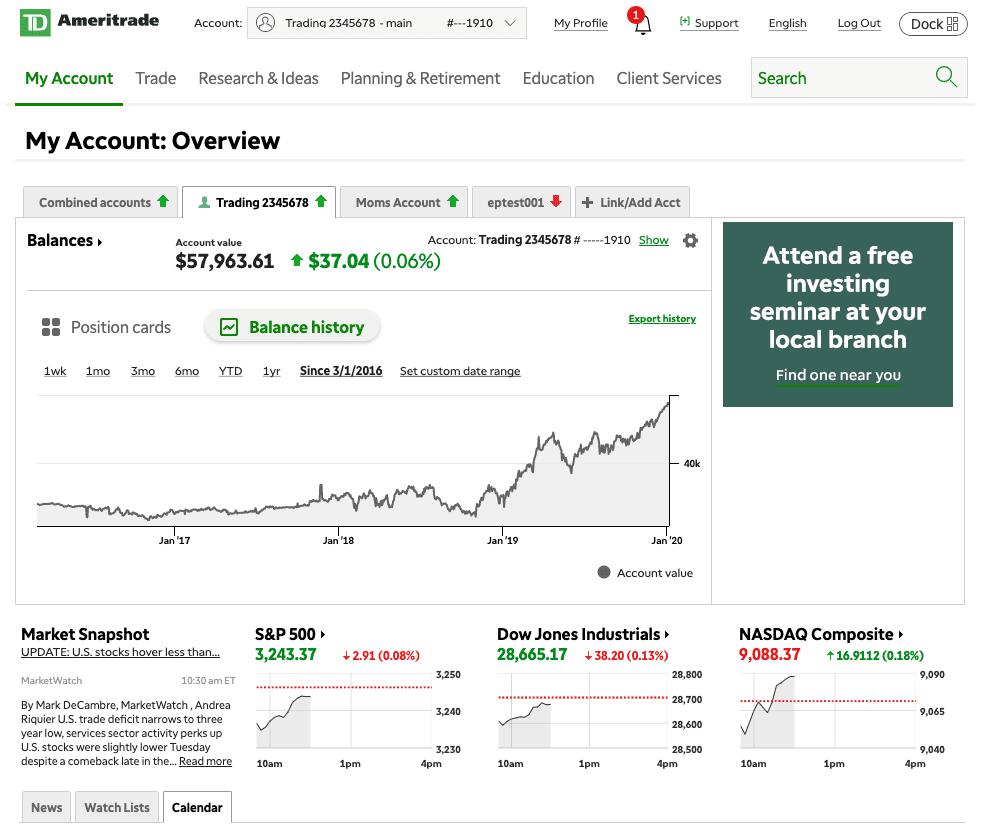

Prior to a name change in September 2021, Charles Schwab Futures and Forex LLC was known as TD Ameritrade Futures & Forex LLC. FOREX.com, registered with the Commodity Futures Trading Commission , lets you trade a wide range of forex markets plus spot metals with low pricing and fast, quality execution on every trade. Closer to home, the New York session tends to feature high liquidity in the morning hours, when it overlaps with the twilight of the London session. However, relatively little movement occurs toward the afternoon hours, particularly near Friday’s closing bell.

- However, combining all these sessions reveals that somewhere in the world is trading forex.

- The best time to trade forex is when the forex market is open across more than one session during an overlap, since the market is more active at this time.

- You can make money trading when the market moves up, and you can even make money when the market moves down.

- In this circumstance, you would be speculating on whether the base quote would increase or decrease in value against the other.

- When you first came to know about the global currency market, you probably came in touch with marketing materials claiming that this market remains open 24 hours a day and seven days a week.

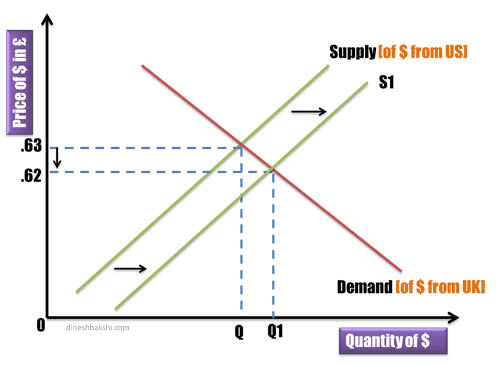

The foreign exchange market is the most liquid financial market worldwide, with an estimated $5.3 trillion traded daily. Forex is an over-the-counter product, hence there is no central physical exchange where the currencies can be traded, unlike shares that are traded on various stock exchanges. Before you dive into these trading sessions, it is always important to get a better understanding of how forex trading works and how to trade forex. Yes, daylight savings times do affect the regular forex market operating hours. The time period between November and March will see adjusted trading hours because of daylight savings. As a general rule, foreign exchange market hours are from Monday to Friday and are paused on the weekends when the major banks are closed.

The Truth About Forex Market Hours

The unemployment rate is a popular method economists use to understand the current state of a country’s economy. Known as a lagging indicator, the unemployment rate will typically increase even after an economy experiences improvement, and it takes some time to drop. The rate often confirms any other indicators that may already exist. A trade deficit takes place when a nation’s imports exceed its total number of exports.

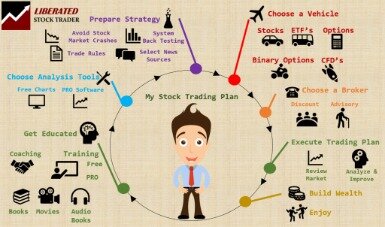

As there are multiple trading strategies and trading styles, identifying when markets open is a crucial step in organising your trading plan. You can stay up to date with the forex economic calendar to be aware of the global economic announcements. And make sure you know how to read the economic calendar so you’re across any significant events or news that may be coming up.

London

Find out more about the benefits and risks of trading forex in our guide to top tips for FX traders. During this time, there is also high volatility, so despite there being a tighter spread initially, major economic news announcements could cause the spread to widen. However, high volatility can be favourable when trading in the forex market.

Unlike with other tools – national bank holidays and weekends are taken into account. So, cross-border investments that require moving funds from one end of the globe to another generally contributes to a higher level of trading volume in the global foreign exchange market. Furthermore, when banks and stock exchanges in more than one major financial centers are open simultaneously, the trading volume and liquidity go up substantially. Even if some brokers allow trading during the weekends, the prices of various currency pairs hardly move on Saturday and Sunday. Because if major financial institutions and professional traders are not placing huge orders that move the market, there is no reason for the solid trends to take place. If there is no restriction though, the general consensus is that the best time to trade is when the different trading sessions overlap.

When more than one market is open at the same time, this increases trading volume and adds volatility which is the degree to which equity or currency prices change. Most of the trading activity for a specific currency pair will occur when the trading sessions of the individual currencies overlap. During the weekdays, there’s always at least one forex trading session open although there are periods of downtime when the market is really quiet and trading volume is low or “thin”. While timing plays a crucial role in scoring wins and profit on the forex market, discipline in executing your trading strategy is equally important in laying the foundation for long-term trading success.

When is the best time to trade forex in Singapore?

This overlapping time frame often sees especially active trading in the AUD/USD, AUD/JPY, EUR/AUD, NZD/USD, AUD/NZD and NZD/JPY currency pairs. One of the biggest plusses that the foreign exchange market https://day-trading.info/ offers traders consists of the fact that currencies trade twenty four hours a day, five days a week. While many investors shy away from such volatile events, professional traders gravitate toward them.

The best time for range traders to trade is during the Asian session. As most major currency pairs are priced to four decimal places, a pip is usually $0.0001 for currency pairs with the US dollar. A currency pair has a high level of liquidity when it is easily bought or sold and there is a significant amount of trading activity for that pair. In terms of the actual trading strategy, trading during the London market opening hour is no different than trading any other time of the day. However, given the significant increase in trading volume at this time, it makes breakout trading much more lucrative.

Understanding the Impact of Forex Market Hours in Your Trading Strategy

This time period tends to have the most liquidity for the Australian and New Zealand Dollars and their crosses. This means that you can start trading Sunday afternoon EST and continue trading non stop all the way until Friday afternoon EST. This round the clock trading feature gives traders with workaholic tendencies a perfect market place in which to operate. Forex trading services provided by Charles Schwab Futures and Forex LLC. Trading privileges subject to review and approval. Forex accounts are not available to residents of Ohio or Arizona.

Can You Make a Living From Forex Trading? – Benzinga

Can You Make a Living From Forex Trading?.

Posted: Wed, 08 Mar 2023 20:12:00 GMT [source]

Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are often found in currency markets. The forex market is open 24 hours a day in different parts of the world, from 5 p.m. For example, AUD/JPY will experience a higher trading volume when both Sydney and Tokyo sessions are open. And EUR/USD will experience a higher trading volume when both London and New York sessions are open. In other words, traders get unnerved by bad results, and they go rogue, abandoning proven trading strategies in hopes of earning back what they’ve lost.

Many brokerages don’t have a minimum amount for trading forex, but you typically need between $50 and $500. Consider making practice trades on a demo platform before you start risking your real money. The ability of the forex to trade over a 24-hour period is due in part to different international time zones. The more traders…trading, the higher the trading volume, and the more active the market. Nevertheless, poor times to trade also exist, and so the sections below will cover the forex market’s time table and the best and worst times to trade.

Spot Gold and Silver Market Hours

Nor PublicFinanceInternational or any of our affiliates makes any recommendation or implies any action based on the information we proved to you. We don’t make any solicitation or recommendation to take any action or trade or invest in any financial instrument, asset, or commodity. Trading CFDs on leverage involves significant risk of sucden financial reveals new brand identity loss to your capital. Finally, one of the most important tools a trader can learn is the stop-loss order. These orders allow a trader to prevent too much loss from accruing from a bad position, allowing the trader to exit the position. E-mail The MT4/MT5 ID and email address provided do not correspond to an XM real trading account.

For those who don’t keep trades open during the night, rollover is not a concern. Also, dealing spreads are typically so wide that you would usually be wise to wait at least until the Tokyo opening to get a better idea of what the market is like. Range Trading works best if a price is moving within relatively narrow ranges and is not breaking through the support or resistance levels. Times of peak market volatility might be good for some strategies and not so good for others. In the country of your residence you should register an account with RoboMarkets Ltd .

Trading Hours

The high liquidity also means that most currency pairs are traded with relatively thin spreads. The euro and pound sterling pairs are the best currencies to trade during the London session. The Asian session starts with the Sydney market opening at 2200hrs GMT.

You can also select the GMT option to check current GMT time in relation to the sessions. The fact that the Forex market never sleeps means it’s easy to overtrade. The information does not represent an offer of, or solicitation for, a transaction in any investment product.