Canadian Investment Funds Course CIFC IFIC Mutual Funds License Course

Contents:

In one ETF, you can access thousands of global stocks and https://forexbroker-listing.com/s. Choose the right portfolio mix based on your risk tolerance and investing style. Aureum has actively solicited investors in Manitoba without authorization. The security of IFC clients is ensured through reserves and investment plans.

- When you invest in equities you buy a share in a company and become a shareholder.

- The broker accepts also deposits with the most popular crypto, the BTC.

- All comparison universes also exhibit some degree of survivorship bias no matter how carefully universes are constructed.

- As the term to maturity on fixed-income securities becomes longer, the more sensitive they become to changes in interest rates.

If a ifc markets review is being measured against a benchmark, the portfolio’s Sharpe ratio can be compared to the Sharpe ratio of the applicable benchmark. The larger the Sharpe ratio, the better the portfolio performed. A group of portfolios can therefore be ranked by their risk-adjusted performance. A money manager with a Sharpe ratio greater than the Sharpe ratio of a bench mark outperformed the benchmark.

Government securities auctions

The Financial Action Task Force is an inter-governmental body whose purpose is to develop and promote national and international policies to combat money laundering and terrorist financing. Financial institutions in FATF member countries have the obligation to identify all clients, including any beneficial owners of property, and keep appropriate records. They are also required to report suspicious transactions to the competent national authorities and to implement a comprehensive range of internal control measures.

- If your analysis has shown that growth was steady, as evidenced by stable inflation, rising corporate profits, steady job creating, and other like activities, it would have suggested expansion.

- First, shareholders equity refers to the amount contributed to the financing of the company when they were first issued in the primary market; that is the amount indicated in the common shares account.

- The coupon represents the “fixed” income the bondholder receives from holding the bind, and is also referred to as interest income, bond income or coupon income.

- Health care reform also provides a $250 rebate for all Medicare Part D enrollees who enter the donut hole in 2010, increases discounts in subsequent years and completely closes the donut hole by 2020.

- The risk that cannot be eliminated or reduced by diversification is called market or systematic risk.

- It should be noted that Brazilian law does not allow the broker to interfere in order to recommend transactions with shares.

You can make your purchase at IFC Markets and get a discount using the IFC Markets discount coupons that we update daily. At 1001couponcodes.ca we believe that getting a discount is much more fun! So we offer the best discount coupons IFC Markets for free. Together we also provide special offers, links, exclusives and many promotions totally at no cost to you.

CIM® – The Recognized Credential for Investment Managers

Identify who is responsible for taxes in dividend income distributed to mutual fund unitholders from a mutual fund trust. Fixed assets are those assets that are expected to last longer than 1 year. These are long-term assets used in the day-to-day operations of a company to produce goods or services the company sells.

Capture the growth around you with our thematic funds focused on innovation. You will gain a better understanding of the financial services landscape in Canada and sharpen your knowledge about various financial instruments like equities, liquid alts, managed and structured products and derivatives. Learn how to manage money on a discretionary basis for sophisticated clients with Chartered Investment Manager (CIM®). Explore different roles and opportunities available in the financial services industry and view the recommended courses and credentials.

The Global Financial Authority and globalfinauthority .com are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities. Finance Monitor and financemonitor .io are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities. Crypto FX Pump and cryptofxpump .com are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities. Nexon Groups and are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities.

Survivorship bias has what direct impact on the longer run funds that remain with a money manager? A quartile sorts performance into 4 equal parts or blocks. For instance, if you are looking at a peer group of 100 Canadian equity funds, there would be four quartiles made up of 25 funds each. The quartiles are given a rank 1, 2, 3 or 4 – to show how well a certain fund performed compared to all other funds in the peer group.

Investor Alert: Markets Xpert and www.marketsxpert .com + www.marketsxpert .co

BlackRock offers a wide range of managed funds and iShares ETFs to help build a diversified investment portfolio. A transparent and rules-based approach to momentum can provide valuable insight into healthy market trends no matter your investment strategy. And between wealth management and asset management will have about 5 trillion of assets. We’re talking about a big stronghold in the wealth management and asset management business, but the investment bank unwind is going to be difficult and probably incur some losses.

A sales fee is that paid upon redemption is called a back end load or deferred sales charge. And on relative valuations compared to historical norms and technical factors, such as supply and demand. Investors willing to assume interest rate risk can add return to their portfolios by holding high-yielding securities from a specific sector.

What does the term Over-the-Counter refer to?

This satellite seminar aims to take an integrated view of the use of granular data by central banks, highlighting the analytical value, the tools and approaches needed to unlock its value as well as the challenges it poses. Inflation in Canada is still too high but has declined from its peak. Carole has recommended a loan to Mark at a cheap interest rate if Mark buys more funds. While duty of care encompasses a wide number of obligations towards parties, the obligation to know the client is of paramount importance in order to ensure the priority of clients’ interests. Due diligence requires that registrants must make all recommendations based on a careful analysis of both information about the client and information related to the particular transaction.

Online Brokers Online Trading Reviews – Investing.com

Online Brokers Online Trading Reviews.

Posted: Sun, 02 Oct 2022 07:00:00 GMT [source]

The ways by which payment can be made within the IFC system may be done by installment. IFCM executes such through Wire Transfers, Credit cards, WebMoney, Skrill, Neteller, OKPAY, Unistream, and account-to-account exchanges. The IFCM also gives the chance to get the VIP account with highly adaptable exchanging conditions, customizable individual instruments, access to a VPS free of charge, no commissions on deposits and withdrawals, and more. Thus, it has become our duty to aid the common trader in making a choice through the survey of agents, giving in-depth data, and apt support. The IFCM also has VIP accounts that are highly-adaptable, flexible, have customizable individual instruments, free VPS access, zero commissions on deposits and withdrawals, alongside others.

Five years after her original investment, the value of Biggar Fund has grown from $37,500 to $67,575. If Sophia sold all of her account now, some of the growth would be taxable when she sold the units and some would have been taxed each year as distributions were received. Identify the arrangement between an insurance company and an individual in which an investor gives a specific amount of money to an insurance company in return for regular payments. A basic interest rate anticipation strategy involves moving between long-term government bonds and very short-term T-bills based on a forecast of interest rates over a certain time horizon. Price sensitivity to interest rate movements increases as the term to maturity increases and the coupon rate decreases.

If these statements are not kept, it may be very time consuming to attempt to reconstruct the adjusted cost base of the investment. A money manager who primarily invests in Canadian T-bills has a less complex job than one who invests in foreign equities, which is reflected in management fees. Fees for a domestic equity mandates general run from 1.5% to 3% of funds’ assets, domestic bonds 1% to 2%, foreign equity 2% to 4% and less than 1% for index funds. Value investors want to buy a firm or equity fund for less than what the assets in place are worth. They avoid paying large premiums for growth companies and seek bargains in mature companies that are out of favour. Value investors have a better chance of succeeding if given a long time horizon .

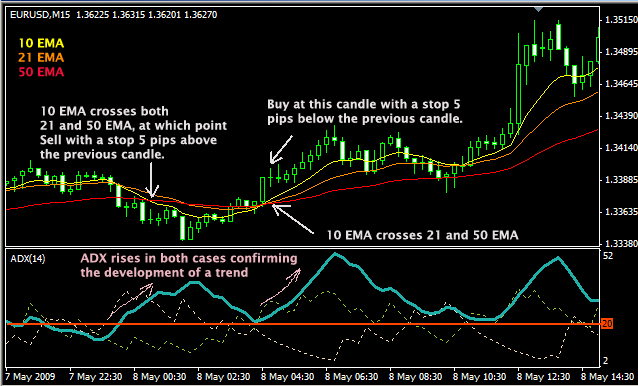

IFC Market Updates / Technical Analysis

Some IFC Markets coupons only apply to specific products, so make sure all the items in your cart qualify before submitting your order. If there’s a brick-and-mortar store in your area, you may be able to use a printable coupon there as well. The best coupons expire soon, so we recommend finalizing your purchase. We usually highlight coupons that are valid for the entire store, in percentage and then fixed value. It should be noted that Brazilian law does not allow the broker to interfere in order to recommend transactions with shares.

6 Best Forex Brokers in Malaysia for 2023 • Benzinga – Benzinga

6 Best Forex Brokers in Malaysia for 2023 • Benzinga.

Posted: Mon, 05 Oct 2020 00:48:38 GMT [source]

The heath reform law prohibits the denial of coverage due to a pre-existing condition for plan and policy years beginning after September 23, 2010 for children under 19, and for all others beginning in 2014. Medicare AdvantageBack To TopAlso referred to as Medicare Part C, the Medicare Advantage program allows Medicare beneficiaries to receive their Medicare benefits through a private insurance plan. Mandatory BenefitsBack To TopA state or federal requirement that health plans provide coverage for certain benefits, treatment or services.

This type of reward is offered to new and existing customers. Binary options are financial instruments relatively new that differ by having a fixed cost, risks and potential profit known in advance. Binary options are popular among novice traders precisely because the potential profit is known before entering a trade and a position can be opened. They work simply by choosing which direction the price will go . Such intermediation is carried out by a financial institution that has authorization to do so. Therefore, in the case of shares, this institution is a stockbroker.

Winnipeg – The Manitoba Securities Commission is issuing a warning to Manitobans about BITCOIN BANK – an online investment ‘bank’ for cryptocurrency allegedly operating from Sunnyvale, California. Bitcoin Bank recently began soliciting Manitobans via classified ad sites and social media to participate in an Initial Coin Offering and trading scheme. Winnipeg – The Manitoba Securities Commission is issuing an investor alert warning the public to exercise extreme caution about aggressive promotion of Crestview Exploration Inc., a British Columbia gold mining company. IFC Markets has served over 20,000 customers over the past 12 years. Through the company, clients have been provided with boundless exchanging tools and several chances to be successful in the trade. IFC Markets hails from the IFCM, an international group engaged with the improvement of ventures in the field of finance.

The law is intended to increase access to health care for more Americans, and includes many changes that impact the commercial health insurance market, Medicare and Medicaid. Medical Loss Ratio Back To TopThe minimum percentage of premium dollars a commercial insurance company must spend on the reimbursement of certain medical costs. The health reform law requires insurers in the large group market to have an MLR of 85% and insurers in the small group and individual markets to have an MLR of 80% . MedicaidBack To TopA federal and state funded program that provides medical and health related services to certain low-income Americans.